Unleash Your Radiance

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Kim Wexler

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

James Cart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

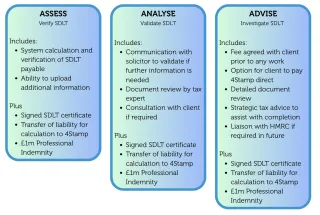

REDUCE RISK. STRENGTHEN COMPLIANCE. PROTECT YOUR FIRM.

INSTANT CERTIFIED VALUES OR IMMEDIATE DIRECT ACCESS TO PROFESSIONAL TAX ADVICE

4Stamp FAQs

Can values be amended once submitted (e.g. if the purchase price changes)?

Yes. When an enquiry is first submitted, a case is created but the values are not fixed. The details are only “locked” once the client has provided an e-signature confirming the information is correct, which happens after the initial calculation has been produced. Until that point, the case details can be amended and resubmitted for recalculation.

Is the client charged multiple fees if amendments are required?

No. Our fee is charged per property transaction, not per individual calculation. If a signed certificate has already been produced and the transaction details subsequently change, a revised certificate can be generated without any additional fee.

Can values be amended after the e-signature has been completed (e.g. if the purchase price changes)?

Yes. If you select the case details view there is an option to request a change to a completed certificate. You can enter the change required and we will unlock the case, make the amendment and re-issue for a new e-signature. The purchaser will receive notification that the previous certificate has been voided and another certificate requiring signature will be issued.

As 4Stamp charges on a per-transaction basis, if a new certificate is required there are no additional charges.

How long does it take to get a verified SDLT certificate?

In most cases the certificate is generated instantly for e-signature by the purchasers. Complex cases may require additional review by a tax advisor. Our team is instantly notified if a transaction needs review. The dashboard within the platform provides a real-time update on the current status of every case raised by your firm.

How can there be an alternate tax payable amount that is also a verified figure?

To enhance clarity and accuracy, we’ve added new dynamic fields to the certificate that appear in specific scenarios. Where the SDLT payable depends on an event occurring before completion, for example, the disposal of another property, the certificate will now display both an alternate tax payable amount and a clear description of which amount applies in each case.

This improvement ensures that the correct SDLT value is explicitly stated for all possible outcomes, while still allowing the purchasers to sign and complete a single certificate that covers both scenarios.

What happens if the client declines the additional Analyse or Advise fee?

Or relies on alternate advice?

If a client chooses not to proceed with our fee and we are therefore unable to verify the transaction details, this will be recorded on the certificate. In such cases, we will provide an SDLT or LTT calculation and issue a certificate for the client to sign. The responsibility for the accuracy of the calculation will rest solely with the client, as the value will not be covered by our professional indemnity insurance.

Where a client has obtained alternative advice and instructs 4Stamp to use that value while declining our own advice, we will note this on the certificate and proceed to generate the calculation and certificate for signature. In this scenario, liability for the calculation will also remain with the client, as it will not fall within the scope of our errors and omissions insurance.

In both scenarios the client remains liable for the initial Assess fee.

Why is there a still a charge for obvious transactions such as First Time Buyers?

First Time Buyers is a great example of something that seems straight forward. However, there are scenarios when even first time buyers who have never purchased a property would not be considered first-time buyers for SDLT purposes:

• people who have inherited properties under certain circumstances

• people who hold certain interests in properties via trusts

• people who hold certain interests in properties via usufructs

• people who have certain interests in foreign properties

• people with a spouse who has certain interests in other residential properties

• people purchasing jointly with a spouse who is not a first-time buyer

• people purchasing jointly with someone who will not be using the property as their main residence

• people who are purchasing a property to be used for any purpose other than as their main residence

How does 4Stamp help reduce professional liability?

Once the purchaser e-signs and validates the data, responsibility for the calculation transfers from the conveyancer to 4Stamp. Each case includes a full audit trail for compliance and CQS review.

How does 4Stamp support CQS compliance?

CQS requires a verification process for SDLT. 4Stamp provides certified verification, a signed certificate, rationale, and SDLT1 instructions all recorded for file audit.

What is the pricing model?

Designed for legal professionals, our service operates on a flexible Pay-As-You-Go basis – with no subscriptions, user limits, or transaction commitments.

Our clear, three-tier pricing model ensures complete transparency, making 4Stamp the smart, reliable choice for delivering accurate, compliant SDLT advice to your clients.

What is the 4Stamp platform?

4Stamp is seamlessly embedded within the cloud-based 4Corners Property portal, combining specialist tax expertise with advanced technology to deliver a truly integrated, end-to-end solution far beyond a simple digitised calculator. This robust platform provides solicitors with real-time access to all necessary updates, data, and supporting information, enabling the delivery of certified, accurate assessments of a purchaser’s Stamp Duty Land Tax liability with confidence and efficiency.

Does 4Stamp integrate with our existing conveyancing workflow?

4Stamp is designed to work alongside your existing case management process. Certificates can easily be uploaded to client files. 4Stamp can be integrated into your existing IT infrastructure stack. Integrations are already live with ActionStep, Xpress Legal, onpoint data, and onesearchdirect. If you already use any of these platforms then you can immediately start using 4Stamp.

Alternatively, as a browser based solution your firm can have its own account with optional two-factor authentication.

As the solicitor completes the calculation details, why is liability still transferred from them?

The 4Stamp process is specifically designed to protect solicitors from liability relating to the accuracy of the transaction details entered. While solicitors may complete the calculation inputs, the purchaser must review and approve all information before the final certificate is issued. By signing the certificate, the purchaser confirms the accuracy of the details provided and assumes full responsibility. If the purchaser does not sign, the liability remains with them, not the solicitor.

Mirador Advisory FAQs

What does your insurance cover?

Mirador maintains professional indemnity insurance of up to £1 million per individual claim. This policy provides protection in respect of errors or omissions made by Mirador when acting on your behalf.

Please note, however, that the insurance does not extend to matters of subjective interpretation. Accordingly, if HMRC were to successfully challenge a position based on differing interpretation or opinion, rather than an identifiable error or omission in our verification process, such a claim would not be covered under our professional indemnity insurance.

What is your information commissioner's office registration?

ICO reference number: ZB554680

Disclosure of personal information

Where you are only a prospective client, we will not share your information with any third parties without your consent.

If you are an employee of a client or one of our professional contacts, we may need to share your contact details with other professionals or client contacts.

Where you are a client, we may have to share certain of your personal data with the parties set out below:

a) HM Revenue & Customs (or a devolved nation’s applicable revenue authority), in order to submit a claim or answer a query on your behalf

b) Any insurer providing professional indemnity insurance to us (we may be required to provide certain client information when we make a claim or for the purposes of obtaining cover)

c) Any referrer of clients who referred you to us (or provided data to allow such referral to take place), in order to confirm to them the outcome of your case and any referral fee which may be payable by us to them

d) Third parties to whom we may choose to sell, transfer, or merge parts of our business or our assets. Alternatively, we may seek to acquire other businesses or merge with them. If a change happens to our business, then the new owners may use your personal data in the same way as set out in our privacy notice

© 2026 Mirador Advisory - All Rights Reserved.

Mirador Advisory is a trading style of RADPR Group Limited, Company Number 14786785.